When you are self-employed you have to pay so much more attention to your finances. After all, you are the one responsible for everything. You become the human resources representative, office manager, financial advisor, and accountant for your business unless you hire others to that for you. Finances can get completely let me tell you. I want to share with 5 tips that I have learned that has helped me over the years.

1. Get a Loan

I know, I know, a loan when you aren’t pulling in any money may seem crazy. However a loan may be what you need to allow yourself a little wiggle room. I wish I had taken one out when I first started. It would have allowed me to put together my brand better and have a better handle on everything. If you are concerned about your credit there are bad credit loans available out there. Honestly, I could have mortgaged my house in the beginning to get better start up than what I had.

2. Shop Around

Whether it is for a loan or for a piece of equipment, make sure that you shop around. I went with the first person I came across a few times and let me tell you I regret it. In fact Lenore also made that mistake. She paid an artist well over a thousand dollars for a custom drawing that in the end looked nothing like what she had wanted. It didn’t even resemble the information she had sent the artist. I wish I could show it to you but one it would hurt her feelings and two I’m pretty sure she burned that thing. The point is to do your research, contact three people you like and see what they can do for you. It will save you money and heartache.

3. Build a Business Emergency Fund

Just like you would for your personal life, your business needs an emergency fund. Recessions happen and stuff breaks. I once had my desktop shut down completely while I had a looming deadline. Luckily this happened on payday and I was able to get an affordable laptop until my desktop could be repair. It was under warranty but I learned that day that dropping $200 I didn’t really have wasn’t going to happen again. I was going to have a back up plan in place.

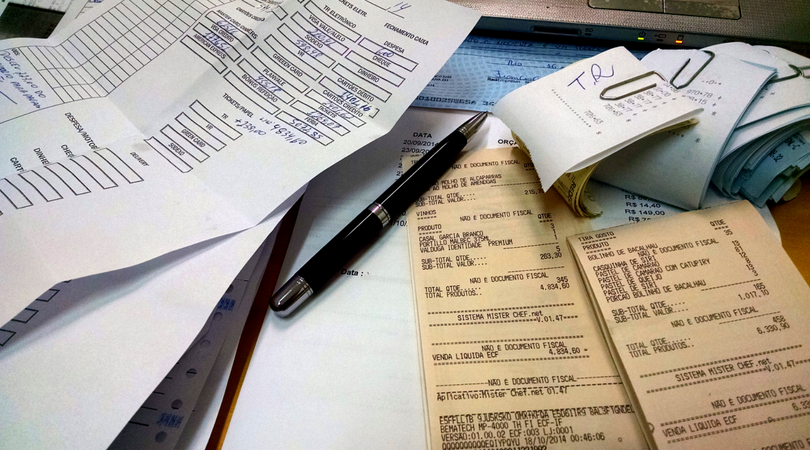

4. Prioritize Your Bills and Expenses

Why is this important? Because even though you want to make enough money to pay your bills and expenses there will be times that isn’t possible. So make sure that you prioritize which bills to pay first, such as your mortgage over your cable bill. Bills that must be paid need to be at the top of your budget and then triage them from there. I exam expenses every three months and things I don’t really use or haven’t used but once I cancel.

5. Understand Your Tax Liability

A lot of people forget about taxes because they were used to them automatically being taken out. That is not the case when you become self-employed whether it is full time or just a side hustle. Uncle Sam needs his share as well. Learning and understanding your tax liability will go a long way in making your life easier.

These are great tips. Thank you for sharing them with us. It can be overwhelming dealing with business loans and taxes.

These are great tips. I especially like the idea of cancelling things you haven’t used in 3 months.

Having a business emergency fund is a great idea. You never know what might happen in the future!

These are great tips. We have an emergency fund set up for my fiance’s small business because you just never know.

These tips will really help me a lot, thanks for sharing!